Buying a rental property in Henderson and Las Vegas

Henderson Real Estate Investment Advice

Las Vegas is 4th on the list of US Cities with perfect markets for real estate investment. If you are considering buying rental property in Henderson and Las Vegas, be sure to study up on the home buying process in general. As an investor, you will need a higher down payment amount and may want to have additional cash set aside for fixing up the home before renting. There are many reasons why buying rental property in Henderson and Las Vegas is a good idea, below are 8 reasons why you should be investing through buying rental property in Henderson and Las Vegas.

Low average home cost

Henderson and Las Vegas have a relatively low average home price. This can make it easy to get into the real estate investment game as you will be able to find homes for sale for $100,000 or under and only need $20,000 for a down payment if you are planning on getting financing for buying rental property in Henderson and Las Vegas.

This can also mean that you can get more bang for your buck if you are looking to purchase a home in the $200,000-$300,000 range. Because Las Vegas is only a few hour drive from many Southern California Cities, many investors come to Henderson and Las Vegas instead of buying locally as they won’t have to start with as much money.

Transient City

Henderson and Las Vegas are transient areas, many people come out to the valley for work, but only stay a few years. Because a high amount of the population, especially compared to most cities, do not plan on settling in the valley, a high amount of the population are renters. With no plans of buying their own home and settling down in the valley, it is a perfect opportunity for investors to supply housing for these renters.

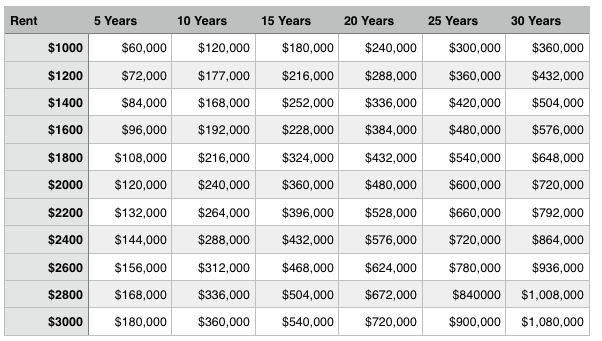

Higher Rents

Because Henderson and Las Vegas are a transient area, most people moving to the area are use to much higher rents and are thrilled to be able to afford more room. This will help you as someone planning on buying a rental property in Henderson and Las Vegas will almost always be able to cover their mortgage and management fees if they purchase their home at the right time. To find out when to buy a rental property in Henderson, be sure to contact an experienced Henderson real estate agent who will be able to discuss your specific situation and help you in buying a rental property in Henderson and Las Vegas.

Many property manager options

Though Las Vegas and Henderson don’t make up a huge metropolis compared to other areas of the United States, there are plenty of property managers to choose from. If you are considering purchasing a home in a more rural area, you may have a difficult time finding the right person to manage your property and your options may be very limited.

When looking for a property manager, be sure to conduct over the phone or in-person interviews first. You will be working with this person for hopefully several years at least, so if there is something that you dislike about them you may want to continue to interview other agents. You also will want to hire a property manager who will not charge you a thing until your home is rented. This is one of the reasons why Nevada Desert Realty’s Property Management services stand out from the rest- they will not charge you any management fees until they have rented your home. They will also be able to help you in the process of buying rental property in Henderson and Las Vegas. To get in contact with these agents, you can reach them at 702-509-1446!

In the top cities with the lowest probability for natural disaster

Henderson and Las Vegas are in the top areas for low probability of natural disaster. Though earthquakes are possible, they do not offer as much of a threat as California. Flooding can also occur in some areas in the valley, so be sure that your real estate agent knows that you don’t want to purchase a home near a flood zone.

This fact can make home insurance cheaper and will give you more peace of mind about buying a rental property in Henderson or Las Vegas as you won’t have to worry as much about the home being destroyed by natural occurrences.

High demand

Housing in Las Vegas and Henderson is currently in high demand. This cuts down on vacancy rates and drives rental prices up in many areas of the Valley. This is great if you are planning on buying a rental property in Henderson and Las Vegas as you will not have to wait long before it begins to generate income.

Roller coaster real estate market

This may seem a little scary, but many real estate investors have made tens of thousands of dollars because they bought when the market was low and sold when the market was at a high. These investors even made and received money through renting out the property while they waited for the home to gain value. This can be riskier and you will have to do a little more research as well as be completely sure that the Henderson real estate agent you’re hiring is honest and is experienced with purchasing rental homes.

Cheap travel costs

If you are an out of state investor interested in buying a rental property in Henderson and Las Vegas, flying out and staying in Las Vegas can be extremely cheap! Flights into Vegas are often very inexpensive and hotel costs during the week are very low, especially if you don’t stay right on the strip.